As a property management professional passionate about helping clients make informed decisions, understanding the latest market trends is key. Here’s a look at the Q3 data shaping investment real estate in the Boise Metro area.

Vacancy Rates

Vacancy rates have shown a modest increase compared to previous quarters, indicating a slight softening in the market. However, the demand for rental properties remains strong, suggesting continued stability in occupancy across both single-family and multi-family units.

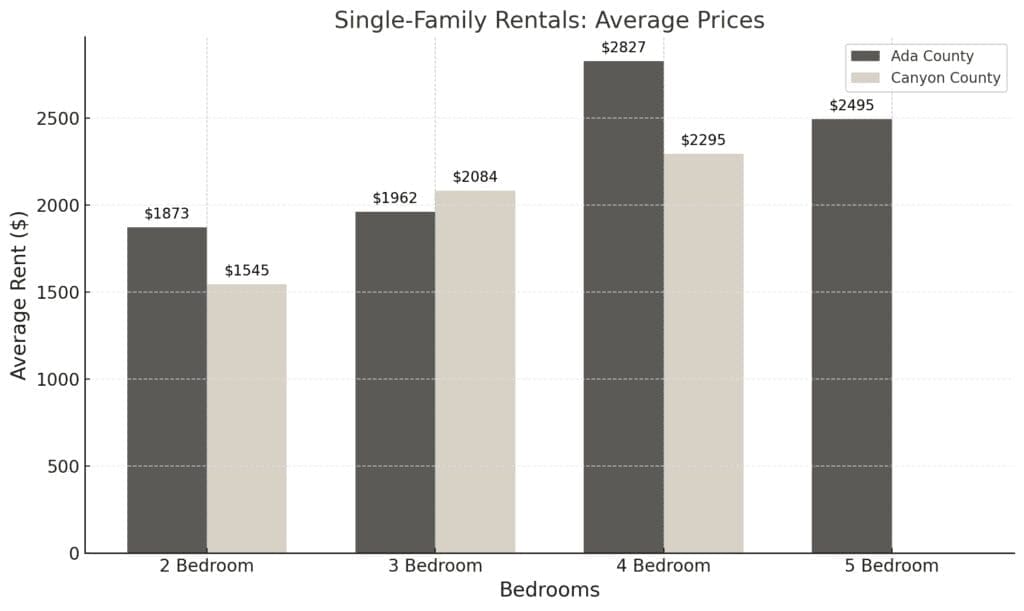

Rental Rates

Ada County: The average rent rate in Q3 2024 was $1,947 per month, reflecting a 2.5% increase from the previous quarter. This rise still indicates an increase, although slower, in appreciation in rental values.

Canyon County: The average rent rate per unit in Q3 2024 was $1,642 per month, reflecting a 4.5% increase from Q2 2024.

Market Dynamics

Despite a slight rise in vacancies, rental rates continue to appreciate. This points to a balanced market where demand remains robust even as more rental units come online. Investors can take confidence in the area’s ability to sustain rental growth while maintaining competitive occupancy rates.

Investment Insights

For property owners and investors, this data underscores the importance of strategic planning. The Boise Metro area continues to present a strong case for rental property investments, with opportunities to maximize returns through competitive pricing and proactive property management strategies.

By leveraging data like this, we ensure our clients stay ahead of market trends, optimizing their investment portfolios for both immediate cash flow and long-term growth. This approach not only sets us apart but also reinforces our commitment to delivering exceptional value in every aspect of property management.