As a property management professional passionate about helping clients make informed decisions, understanding the latest market trends is key. Here’s a look at the Q4 data shaping investment real estate in the Boise Metro area.

Vacancy Rates Continue to Tighten

The overall vacancy rate for Ada and Canyon counties dropped to 1.90%, a 1.79% decrease from Q3 2024. Year-over-year, the vacancy rate saw a more modest 0.27% decline compared to Q4 2023.

- Ada County: 1.62% vacancy rate

- Canyon County: 3.28% vacancy rate

- Single-Family Homes: 2.36% in Ada, 2.58% in Canyon

- Multi-Family Units: 1.09% in Ada, 3.66% in Canyon

This data reinforces Boise’s rental market resilience, with rental demand holding steady even amid seasonal shifts.

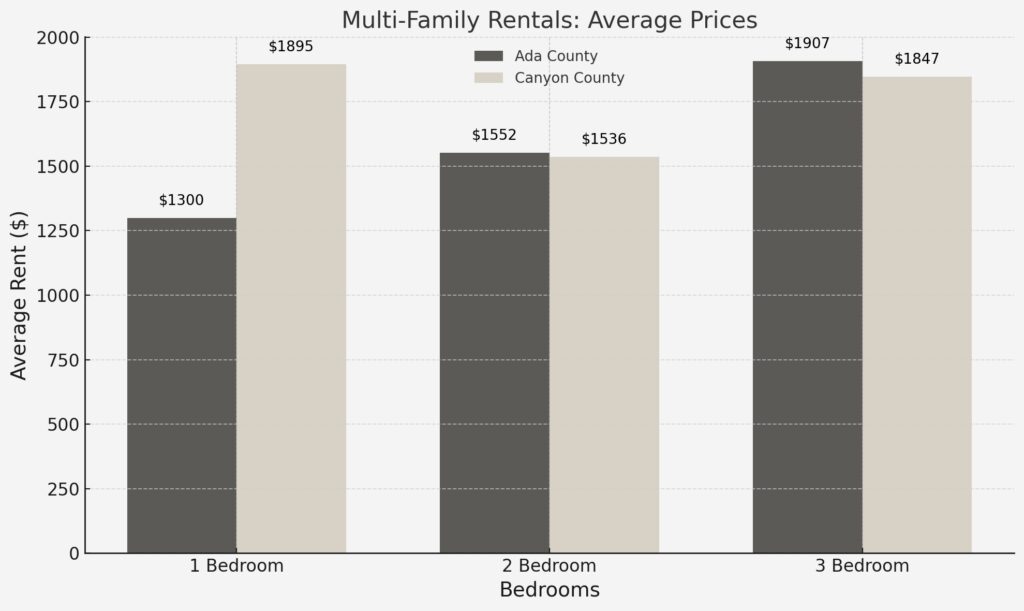

Diverging Rental Trends in Ada vs. Canyon County

The rental pricing trends in Q4 2024 tell two different stories for Ada and Canyon County.

Ada County: Market Softening

- Single-Family Homes saw a $290 per unit decline in marketed rent.

- Multi-Family Units increased by $96 per unit.

- Overall Average rent dropped to $1,935 per month.

Despite a stable vacancy rate, these numbers suggest a softening rental market, particularly for single-family homes.

Canyon County: A Surge in Pricing and Units

- Single-Family Homes saw a $496 per unit increase.

- Multi-Family Units spiked by $449 per unit.

- Overall Average rent jumped to $2,255 per month.

With many high end developments having come to market we see higher rental prices and a vacancy rate over 3%, Canyon County is experiencing increased demand, however it will take some time for the vacancy to return.

Key Takeaways for Investors & Property Owners

Boise remains a landlord-friendly market with a sub-2% overall vacancy rate.

Canyon County rents surged, outpacing Ada County in key multi-family and single-family segments due to new development project completions.

Ada County is seeing a price correction in single-family homes, presenting opportunities for renters and the need for proactive resident retention.

Market stabilization trends continue, with slight declines in rental growth in some areas but strong occupancy rates as compared to other markets of similar size.