I love reading these kinds of annual reports, and since I did, here’s what you need to know and what we are paying attention to:

Top Destinations for Millionaires

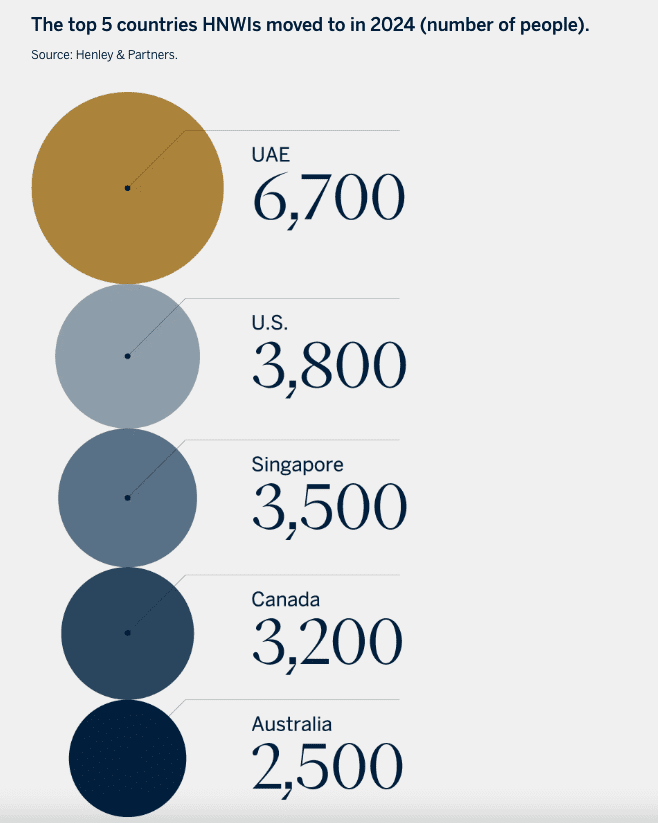

🇦🇪 UAE: Leading the pack at at no surprise with 6,700 HNWIs attracted by luxury real estate, incredible tax incentives, and golden visas.

- Property Insight: The Dubai luxury market is booming, with penthouses in Palm Jumeirah selling for $20M+, and demand for turnkey, high-end apartments rising sharply.

🇺🇸 USA: A strong second, gaining 3,800 millionaires—yet seeing the lowest level of foreign-buyer purchases since 2009.

- Market Reality: Despite having the second-highest millionaire inflow, the U.S. is experiencing the lowest level of foreign-buyer purchases since 2009. Higher interest rates and a strong dollar are slowing international transactions. According to the National Association of Realtors, international buyer purchases from April 2023 to March 2024, saw a 21.2% drop year-over-year.

- Property Hotspots: Florida and Texas remain the exception to the rule, consistently attracting HNWIs and strengthening their luxury markets. Silicon Valley is also holding strong, especially in the $10M+ range, where ultra-wealthy buyers are less impacted by currency restrictions and interest rates.

🇸🇬 Singapore: Rounding out the top three with a net inflow of 3,500.

- Property Insight: Singapore’s prime real estate averages around $3,500 per square foot. The city-state offers exclusivity and stability, drawing HNWIs from Asia and beyond.

🇮🇹 Italy: Attracting 2,200 HNWIs, particularly to the scenic regions of Tuscany and Lake Como.

- Property Insight: Italy’s ‘€1 home’ schemes in smaller towns are still popular, but the real action is in restored historic villas and luxury apartments in Rome and Milan.

🇬🇷 Greece: Welcomed 1,200 HNWIs, benefiting from its Golden Visa program.

- Property Insight: Coastal properties in Mykonos and Santorini are in high demand. Seafront villas can start at €1.5 million, with rental yields bolstered by strong tourism.

Where Millionaires Are Leaving

🇨🇳 China: 15,200 HNWIs exited in 2024, primarily moving to Singapore, Canada, Japan, or the U.S.

🇬🇧 UK: Doubling its outflow to 9,500, driven by rising taxes, political uncertainty, and Brexit impacts.

🇮🇳 India: Outflows slowed to 4,300, showing a bit more stability.

Why They’re Moving

- Political Climate: The #1 factor influencing where HNWIs buy or sell.

- Economic Stability: Interest rates, inflation, and tax reform are also top of mind.

- Lifestyle & Investment Opportunities: High-end real estate markets and favorable tax regimes are major draws.

What This Means for Real Estate

The luxury property market is feeling the ripple effects. Countries gaining wealthy residents are seeing robust growth in high-end real estate, while those with major outflows may face softer markets.

For investors and real estate pros, staying ahead of these trends is key. The world is moving fast, and opportunities are opening up for those ready to act.

P.S. For those of you following us personally, you may be asking where this leaves Spain? As of the time of this writing there are still substantial investment inflows due to the announcement of Spain’s ending the Golden Visa program. The impending termination has increased applications mostly from the U.S. by 200%. I personally know 3 different people from Boise who are closing on property in Spain and will make the deadline to apply. Once April has come and gone I imagine that the market will have some loss but to date that is yet to be seen.